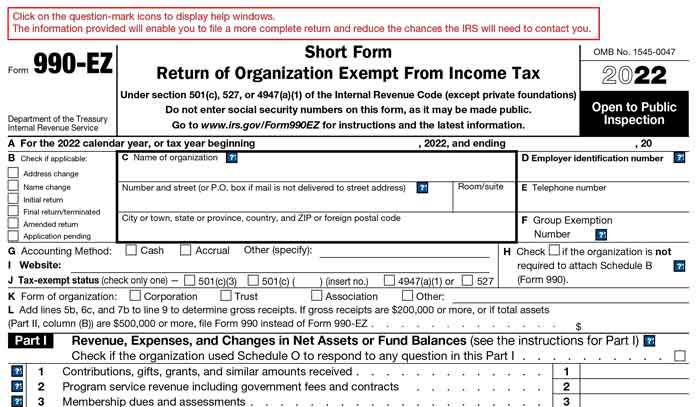

What is Form 990-EZ?

Form 990-EZ or the 990 Short Form is an information tax form required to file annually by the non-profit organizations to report their tax-exempt activities, financial details, and other important operations to the IRS. Learn more about Form 990-EZ

Who must file Form 990-EZ?

Form 990-EZ must be filed by tax-exempt organizations, nonexempt charitable trusts, and section 527 political organizations. The organizations with gross receipts less than $200,000 or total assets less than $500,000 must file Form 990-EZ.

Click here to learn more about Form 990-EZ filing requirements.

When to file Form 990-EZ?

Nonprofits & Tax-Exempt Organizations must file Form 990-EZ by the 15th day of the 5th month after the tax year ends. If the organization follows a Calendar Tax year, the due date to file Form 990-EZ would be May 15, 2023. Find your 990-EZ due date

If the regular due date falls on a Saturday, Sunday, or legal holiday, file by the next business day.

Form 990-EZ Schedules

Organizations that file Form 990-EZ may be required to complete and attach the required schedules depending on the information provided on the return. The schedules are generally used by the organization to provide additional information to the IRS regarding certain details of the company.

Check this step by step Form 990-EZ Instructions to complete your Form with required schedules.

There are a total of 8 schedules that applicable for Form 990-EZ:

Schedule A:

Section 501(c)(3) organizations, section 4947(a)(1) charitable trusts that aren’t considered as private foundations and organizations that come under sections 501(e), 501(f), 501(j), 501(k), or 501(n) will be required to complete and attach Schedule A along with their Form 990-EZ to provide information about the organization’s public charity status and public support.

Schedule B:

Schedule B is attached by organizations that file Form 990-EZ to provide the IRS with information about contributions, grants, bequests, devises, and gifts of money or property. This schedule is used to report on the contributions received by the organization.

Schedule C:

Section 501(c)(3) organizations, section 527 political organizations, and other organizations that have been involved in political and lobbying activities have to complete and attach a Schedule C along with the Form 990-EZ.

Schedule E:

Schools are required to complete and attach Schedule E along with their Form 990-EZ to provide the IRS information about the schools.

Schedule G:

Schedule G is completed and attached by the tax-exempt organizations to report about an organization’s professional fundraising services, fundraising events, and gaming events.

Schedule L:

Schedule L is used by an organization to provide the IRS with information on certain financial transactions or arrangements that occurred between an organization and a disqualified person or other interested persons. It is also used to find out if a member of the organization's governing body is an independent member.

Schedule N:

Schedule N is used by organizations to provide the IRS with information about their organization being dissolved, going out of business or disposing of more than 25% of its net assets.

Schedule O:

Organizations generally use Schedule O if they have to provide the IRS with detailed and narrative information about the form and also to give answers to specific questions within the form.

Click here to learn more about 990-EZ Schedules.

Instructions to complete Form 990-EZ

Form 990-EZ consists of a total of six parts. Here is a brief of each part

Part I - Revenue, Expenses, and Changes in Net Assets or Fund Balances:

Every organization filing Form 990-EZ must complete Part I. The first section of Part I is the revenue, where the revenue earned during the tax year should be recorded. The next section is about the expenses incurred by the organization during the tax year, and the last section on Part I is the Net Assets which is ideally the difference between the revenue and the expenses of the organization.

Part II - Balance Sheets:

All the organizations that file Form 990-EZ must complete Part II. The form will be considered incomplete if the Balance Sheet in the Form 990-EZ isn’t completed. The organizations are required to enter the details about the assets of the organization at the beginning of the year and the end of the year.

Part III - Statement of Program Service Accomplishments:

Program services are activities that are conducted by the organization which serves the organization's exempt purpose. The organizations are required to enter the details about the organization’s top three Program Services in terms of the highest revenue. The revenue earned through all the program services held by the organization throughout the tax year should be mentioned in Line 32 of Part III.

Part IV - List of Officers, Directors, Trustees, and Key Employees:

This part of the Form 990-EZ is to list all the officers, directors, trustees, and other key employees of the organization and to enter the details of the compensation received by all these people from the organization during the tax year.

Part V - Other Information : (backlinks could be provided for blue lines)

This part of the Form 990-EZ is completed to provide the IRS with additional information about the organization regarding political activities, transactions to a disqualified person, prohibited tax shelter transaction, donor-advised funds, unrelated business income, an organization going out of business and other significant changes made to the organization or its governing documents to name a few.

The organization that requires to attach a Schedule O to explain the details entered in this part has to check the box on the heading of Part V.

Part VI - Section 501(c)(3) Organizations Only:

This part is required to be completed only by section 501(c)(3) organizations. The organizations that fill Part VI of Form 990-EZ are required to enter information about the activities of these charitable organizations.

All the organizations that complete Part VI in Form 990-EZ are required to attach a Schedule A.

The organizations that answer “Yes” to Line 48 of Part VI are required to attach a Schedule E.

The organizations that answer “Yes” to Line 47 of Part VI are required to attach a Schedule C.

The organization that requires to attach a Schedule O to explain the details entered in this part has to check the box on the heading of Part VI.

Visit https://www.expresstaxexempt.com/form-990-ez/form-990-ez-instructions/ to learn more about Form 990-EZ instructions.

Instructions on how to file Form 990-EZ

Form 990-EZ can be filed through two ways: Electronic or Paper Filing

However, the IRS recommends every organization to file 990-EZ electronically for faster processing and to know the status of the filing instantly.

E-Filing

If you are filing Form 990-EZ for a tax year beginning on or after July 2, 2019, you must file the return electronically.

Filing Form 990-EZ electronically is quick and easy. It takes less time to process the return, and you instantly get to know the status of the filing.

The IRS prefers the electronic filing of Form 990-EZ.

Also, e-filing with an IRS-authorized e-file service provider such as form990ezinstructions.com is more secure when compared to the paper filing.

Paper Filing

If you choose to file 990-EZ by paper, you must fill the form, print and send the hard copies to the following address:

To file the 990-EZ return, mail or deliver it to:

Department of the Treasury,Internal Revenue Service Center,

Ogden, UT 84201-0027

If the organization's principal business, office, or agency is located in a foreign country or U.S. possession, mail or deliver the return to:

Internal Revenue Service CenterP.O. Box 409101

Ogden, UT 84409

Know more about Form 990-EZ mailing address.

Form990ezinstructions.com - A Cloud Based Software to E-file Form 990-EZ

Form990ezinstructions.com provides an easy to use interface to file Form 990-EZ electronically. With our step by step filing process, preparing and transmitting your Form 990-EZ is simple now.

Also, our support team is always ready to assist you with any queries that you may have during the filing process.